Are you looking for Guaranteed Installment Loans For Bad Credit No Credit Check? If Yes, You are at the Place.

If you have bad credit or no credit history at all or bad credit, getting approved for a loan can feel nearly impossible. Many lenders immediately reject applications from people with low credit scores, leaving you with limited and often expensive options. This is where guaranteed installment loans with no credit check come into play.

These types of loans are designed for people who need urgent financial help but don’t meet the usual borrowing standards. In this article, we’ll explain Guaranteed Installment Loans For Bad Credit No Credit Check.

What Are Guaranteed Installment Loans for Bad Credit?

Guaranteed installment loans for bad credit are personal loans aimed at people with low credit scores who struggle to qualify for traditional credit. These loans come with a fixed loan amount and a set repayment schedule, typically paid monthly over a few months or years. They are often considered a safer alternative to Extremely Bad Credit Loans, especially when borrowers want more predictable payments and slightly better terms.

What makes them “guaranteed” is that many lenders promise a high approval rate, even for borrowers with past bankruptcies, missed payments, or very poor credit scores. However, it’s important to know that “guaranteed” doesn’t mean everyone will be approved, lenders still consider your ability to repay.

What Are Installment Loans for Bad Credit No Credit Check?

These are installment loans offered specifically to borrowers with bad credit, without a traditional credit check. Instead of relying on your FICO score or full credit history, lenders review:

- Your current income

- Employment status

- Bank account activity

- Residency and identification

These loans are popular among people who want to avoid hard inquiries that may hurt their credit score further. Since the repayment happens in scheduled installments, they are easier to manage than payday or cash advance loans that require full repayment at once.

What Are Guaranteed Installment Loans for Bad Credit No Credit Check?

Guaranteed installment loans for bad credit with no credit check are loans designed for people with poor or no credit history. These loans offer fixed monthly payments and do not require a traditional credit check, making them accessible to borrowers who may be denied by banks.

Approval is usually based on income and ability to repay rather than credit score. They are often seen as a more manageable alternative to No Denial Payday Loans Direct Lenders Only No Credit Check, offering longer repayment terms and lower risk of rollover debt.

This type of loan combines two key features:

- Guaranteed Approval: High chances of approval for borrowers with poor or limited credit history.

- No Credit Check: Lenders skip the traditional credit review process and rely on alternative information like income and bank activity.

This makes these loans one of the few options available to borrowers who are financially stable but credit-challenged. They are ideal for emergency needs, though they often come with higher interest rates.

Top 5 Guaranteed Installment Loans For Bad Credit No Credit Check

Here are the list of Top 5 Guaranteed Installment Loans For Bad Credit No Credit Check..

1. OppLoans

OppLoans is a reputable online lender that focuses on providing installment loans to consumers with poor or no credit history. Unlike traditional financial institutions, OppLoans does not perform a hard credit check during the application process. Instead, it uses alternative data such as employment history and income to assess your ability to repay.

OppLoans stands out because it reports your payments to the major credit bureaus (Equifax, Experian, and TransUnion), which means you have the opportunity to rebuild your credit by making on-time payments. The application process is simple and entirely online, and most qualified borrowers receive funding within one business day.

Key Features:

- Loan amounts: $500 to $4,000

- Repayment terms: 9 to 24 months

- APR: 59% to 160%

- No hard credit check

- Reports to all three major credit bureaus

- Fast funding (often next business day)

Pros:

- Does not rely on credit score for approval

- Helps build credit with on-time payments

- Fixed payments and clear loan terms

- Better alternative to payday loans

- Transparent and regulated

Cons:

- APRs are high compared to traditional loans

- Not available in all states

- Lower maximum loan amount than some competitors

Why Choose OppLoans:

OppLoans is a solid choice for borrowers who want fast funding, manageable installment plans, and the chance to rebuild credit through on-time payments.

2. Rise Credit

Rise Credit is an online lender offering high-approval installment loans to borrowers with bad credit. Rise is known for its flexible repayment terms and the unique feature of Rate Reduction Rewards, which lowers your interest rate if you make consistent on-time payments. The loan amounts and terms depend on your state and personal financial profile, but Rise aims to provide responsible and manageable loans.

Rise also provides free access to credit monitoring tools so borrowers can keep track of their credit progress. The online application process is user-friendly and often results in same-day or next-day funding.

Key Features:

- Loan amounts: $300 to $5,000

- Repayment terms: 4 to 26 months

- APR: 60% to 299%

- No hard credit check

- Offers rate-lowering rewards

- Credit monitoring tools included

Pros:

- Designed specifically for bad credit borrowers

- Rate reduction for on-time payments

- Flexible repayment schedules

- Quick loan disbursal

- Helpful financial tools provided

Cons:

- High starting interest rates

- Loan availability and terms vary by state

- May not report to all credit bureaus

Why Choose Rise Credit:

Rise is ideal for borrowers who need a larger loan and want repayment flexibility. Its rate-lowering program rewards borrowers for financial responsibility, which is rare in the bad-credit loan space.

3. NetCredit

NetCredit offers unsecured personal loans and lines of credit to individuals with subprime credit. One of NetCredit’s key advantages is that it uses a soft credit inquiry during prequalification, which doesn’t affect your credit score. Their loans are suitable for those who need larger loan amounts or longer repayment periods.

NetCredit focuses on your entire financial picture rather than just your credit score. They’re known for transparent pricing and no hidden fees. You can also customize your loan terms during the application process to better suit your financial situation.

Key Features:

- Loan amounts: $1,000 to $10,000

- Repayment terms: 6 to 60 months

- APR: 34% to 155%

- No hard credit check during application

- Customizable loan terms

- Funds may be available within 1 business day

Pros:

- Higher loan limits for bigger financial needs

- Soft credit inquiry doesn’t hurt your score

- Long repayment terms available

- Transparent fee structure

- Customizable loan offers

Cons:

- Still relatively high interest rates

- Not available in all states

- Full approval may include a hard inquiry later

Why Choose NetCredit:

NetCredit is best for people who need more time to repay and want a higher borrowing limit. Its flexible repayment terms and larger loan amounts make it suitable for major expenses like medical bills or home repairs.

4. Fig Loans

Fig Loans is a socially responsible lender that partners with nonprofit credit unions to provide affordable, small-dollar installment loans. Fig Loans was created as a consumer-friendly alternative to payday loans, offering fair rates and transparent repayment terms. What sets Fig apart is their focus on helping borrowers build long-term financial health, not just access short-term cash.

They also offer credit builder loans for people who want to improve their credit without taking on significant debt. Payments are reported to all three major credit bureaus, and they do not rely on traditional credit checks to approve loans.

Key Features:

- Loan amounts: $300 to $1,000

- Repayment terms: 4 to 12 months

- APR: Around 36%

- No credit score required

- Reports to credit bureaus

- Designed to build credit and save money

Pros:

- One of the most affordable loan options

- Transparent and ethical lending practices

- Great for building or repairing credit

- No hidden fees

- Works with nonprofits to help underserved communities

Cons:

- Smaller loan amounts

- Limited state availability

- Not ideal for major or urgent expenses

Why Choose Fig Loans:

If you want an affordable, ethical loan option that helps build credit, Fig Loans is one of the best. They’re transparent and regulated, with a strong focus on financial education and fairness.

5. CashUSA

CashUSA is not a direct lender but a trusted loan aggregator platform that connects borrowers with a wide network of lenders. It’s designed for people with all types of credit, including poor or no credit. By filling out a single online form, you can receive multiple loan offers from various lenders that specialize in no-credit-check installment loans.

The platform is free to use and can offer loan amounts as high as $10,000, depending on your qualifications. While some lenders in the network may still check your credit, many are focused on income-based approval.

Key Features:

- Loan amounts: $500 to $10,000

- Repayment terms: 3 to 72 months

- APR: 5.99% to 35.99% (depending on lender)

- No obligation to accept an offer

- Quick prequalification process

- Funds often available within 24 hours

Pros:

- Access to multiple lenders through one application

- No fees to use the platform

- Larger loan amounts available

- Simple online application

- Some lenders approve without credit checks

Cons:

- Not a direct lender – terms depend on third parties

- Some offers may involve hard credit checks

- Risk of spam or upsell from lenders you don’t choose

Why Choose CashUSA:

CashUSA is perfect if you want to explore multiple loan offers in one place. While not all lenders in the network avoid credit checks, many specialize in bad credit loans and have flexible eligibility requirements.

Table of Guaranteed Installment Loans For Bad Credit No Credit Check –

| Lender | Loan Amount | APR Range | Credit Check | Reports to Bureaus | Good For |

|---|---|---|---|---|---|

| OppLoans | $500–$4,000 | 59% – 160% | No Hard Check | Yes | Fast approval and credit building |

| Rise | $300–$5,000 | 60% – 299% | No Hard Check | Sometimes | Flexible terms with rewards |

| NetCredit | $1,000–$10,000 | 34% – 155% | Soft Check | Yes | Larger loans and flexible plans |

| Fig Loans | $300–$1,000 | ~36% | No Credit Score Needed | Yes | Affordable and ethical lending |

| CashUSA | $500–$10,000 | 5.99% – 35.99% | Varies | Varies | Comparing multiple offers easily |

How to Qualify for Guaranteed Installment Loans For Bad Credit No Credit Check?

Even though these loans don’t require on your credit score, lenders still need to ensure that you can repay what you borrow. The approval process focuses more on your current financial health than your credit history.

Here’s what most lenders require to qualify:

1. Proof of Income

Lenders want to make sure you can repay the loan. You’ll typically need to submit:

- Recent pay stubs

- Bank statements showing deposits

- Award letters for government benefits (SSI, SSDI, unemployment, etc.)

- Tax documents if you’re self-employed

2. Government-Issued ID

To verify your identity and prevent fraud, you’ll need a valid ID such as:

- Driver’s license

- Passport

- State-issued identification card

3. Active Checking Account

Most lenders deposit funds directly into your bank account and set up automatic withdrawals for repayment. An open, active checking account in your name is usually required.

4. Proof of Residency

You may be asked to verify where you live. Acceptable documents include:

- Utility bill with your name and address

- Lease or rental agreement

- Bank statement with your address

5. Employer Contact or References (Optional)

Some lenders will also ask for your employer’s contact information or personal references to help verify employment stability or identity, especially for larger loan amounts.

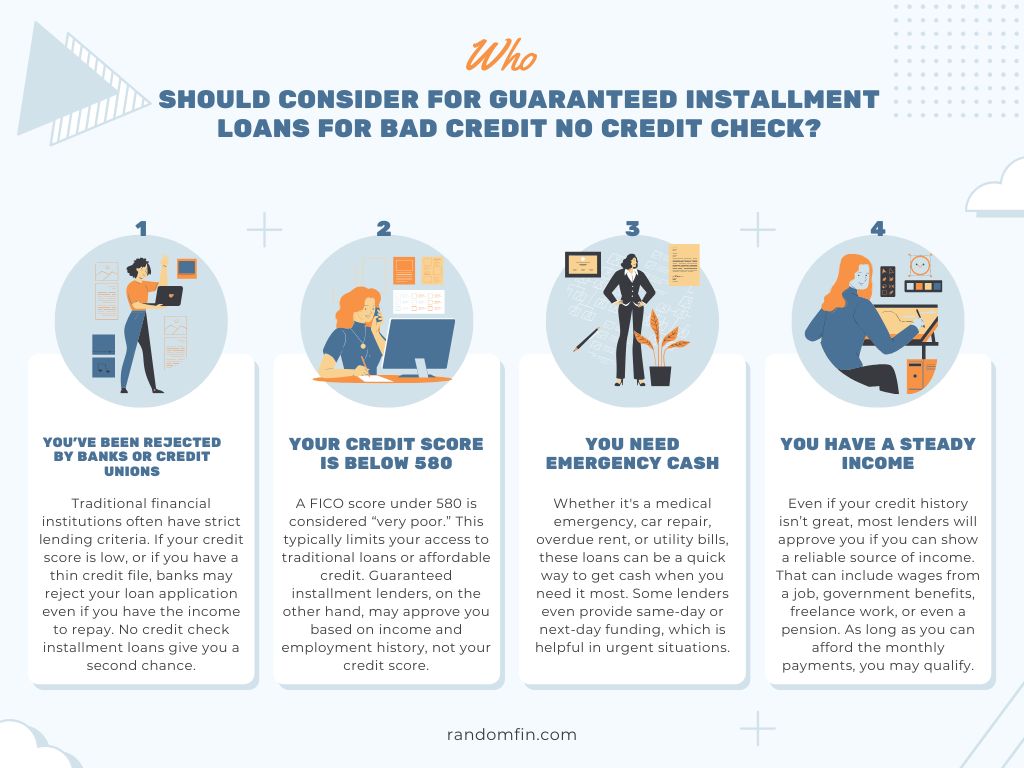

Who Should Consider for Guaranteed Installment Loans For Bad Credit No Credit Check?

Guaranteed Installment Loans For Bad Credit No Credit Check aren’t for everyone but they can be a smart short-term solution for people facing specific financial challenges. These loans are ideal for individuals who may have been turned down by traditional banks but still have the financial ability to make consistent repayments.

Here’s a list of things that may benefit most from these types of loans:

1. You’ve Been Rejected by Banks or Credit Unions

Traditional financial institutions often have strict lending criteria. If your credit score is low, or if you have a thin credit file, banks may reject your loan application even if you have the income to repay. No credit check installment loans give you a second chance.

2. Your Credit Score Is Below 580

A FICO score under 580 is considered “very poor.” This typically limits your access to traditional loans or affordable credit. Guaranteed installment lenders, on the other hand, may approve you based on income and employment history, not your credit score.

3. You Need Emergency Cash

Whether it’s a medical emergency, car repair, overdue rent, or utility bills, these loans can be a quick way to get cash when you need it most. Some lenders even provide same-day or next-day funding, which is helpful in urgent situations.

4. You Have a Steady Income

Even if your credit history isn’t great, most lenders will approve you if you can show a reliable source of income. That can include wages from a job, government benefits, freelance work, or even a pension. As long as you can afford the monthly payments, you may qualify.

Pros and Cons of Guaranteed Installment Loans For Bad Credit No Credit Check

Here are the list of Pros and Cons of Guaranteed Installment Loans For Bad Credit No Credit Check..

Pros of Guaranteed Installment Loans For Bad Credit No Credit Check

- Fast Approval: Many lenders approve and fund the loan on the same day.

- No Hard Credit Check: Your credit score won’t take a hit.

- Fixed Payments: Predictable monthly installments make repayment manageable.

- Available for Bad Credit: Open to borrowers with very low credit scores or no score at all.

Cons of Guaranteed Installment Loans For Bad Credit No Credit Check

- Not Truly Guaranteed: Most lenders still require proof of income or bank account history.

- High Interest Rates: These loans come with higher APRs than traditional personal loans.

- Shorter Repayment Terms: Some lenders offer short repayment windows, increasing monthly burden.

- Scams Are Common: Many fake “guaranteed loan” sites prey on desperate borrowers.

Tips to Avoid Scams where applying for Guaranteed Installment Loans For Bad Credit No Credit Check

Unfortunately, the “guaranteed no credit check loans” can be a breeding ground for scams. Fraudsters prey on people who are in desperate need of money by making fake promises, charging upfront fees, or stealing personal information.

Here’s how you can protect yourself when applying for a loan online:

1. Verify the Lender’s Contact Details

Always check that the lender has:

- A physical office address

- A working customer service phone number

- A legitimate business website

If the lender only operates through social media or email and refuses to talk on the phone, that’s a red flag.

2. Read Reviews on Independent Platforms

Search for the lender on Trustpilot, Better Business Bureau (BBB), or Google Reviews. Real customer experiences can tell you a lot about whether the company is legitimate and how they handle complaints.

3. Never Pay Upfront Fees

A legitimate lender will never ask you to pay:

- Application fees

- “Processing” or “insurance” fees via gift cards or money orders

- Deposits before you receive the loan

Upfront fees are one of the most common signs of a loan scam.

4. Make Sure the Website Is Secure

Look for the “https://” prefix in the lender’s web address. The “s” stands for secure, meaning your data is encrypted. Also, avoid entering personal or banking information on sites without security certifications.

FAQs

Are Guaranteed Loans Really Guaranteed?

Not exactly. While approval chances are high, no legitimate lender can 100% guarantee a loan without first checking your financial situation.

Is There Any Insurance Available For Guaranteed Installment Loans With No Credit Check?

Yes, some lenders offer optional loan protection insurance, such as payment protection or credit life insurance, which can help cover your loan in case of job loss, disability, or death. While not related to the loan itself, people often search for financial relief through other options like Cheap No Down Payment Car Insurance to manage expenses more affordably during tough times.

Will My Credit Score Improve with These Loans?

If the lender reports to credit bureaus and you repay on time, your credit score may improve gradually.

Can I Get Such a Loan if I’m Unemployed?

Possibly, if you have an alternative source of income such as benefits, a pension, or a side hustle.

Conclusion

GuGuaranteed Installment Loans For Bad Credit No Credit Check can be a lifeline if you’re struggling with poor credit and need cash fast. However, these loans should be used with caution due to high interest rates and the risk of falling into a cycle of debt. Before accepting any offer, compare multiple lenders, read the fine print, and ensure you can handle the monthly payments. If used responsibly, these loans can offer financial relief and even help you start rebuilding your credit over time.